Payee non-resident individual in Malaysia that receives the payments. It varies between jurisdictions in the types of income withholding tax is deducted from.

This amount has to be paid to LHDN.

.png?sfvrsn=c37bebe1_3)

. Based on Example 2 of the guidelines payment for online service via a platform to non- resident is subject to withholding tax under Section 109 of the Act if the services are performed in Malaysia. 10 December 2019 Page 5 of 42 Example 3 Champ Ltd a company resident in India sold 3 stainless steel boilers to Doublesteel Sdn Bhd a steel manufacturer in Malaysia at a price of RM1 million in March 2017. Payer individual that conducts business in Malaysia.

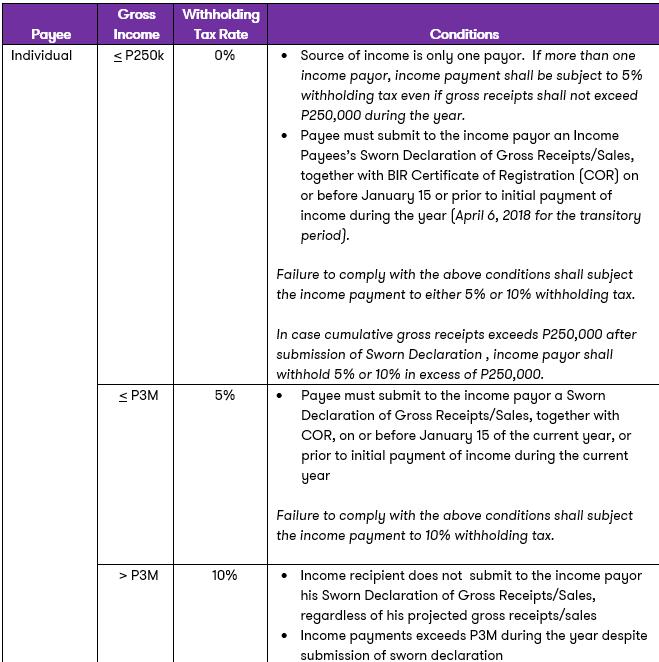

WITHHOLDING TAX ON SPECIAL CLASSESS OF INCOME Public Ruling No. 19 minutes agoIn the Air India Limited case the Delhi High Court has once again reiterated that for payments made by an Indian tax resident to a non-resident the Indian payor will be correct in applying the withholding tax rate prescribed under the double taxation avoidance agreement DTAA if the provisions of the DTAA are more beneficial than the provisions of Indias. The tax withheld must be paid to the Internal Revenue Department IRD within fifteen days from the date of withholding.

Example WTH tax amount is calculated by applying a particular percentage rate on base amount. Damit Pty Ltd an Australian company is engaged by MM Sdn Bhd to build a dam in Ulu Langat Selangor. The Paying Agent shall exclude and withhold from each distribution of accrued interest on the Deposits as defined in.

The Company may withhold from any benefits payable under this Agreement all federal state city or other taxes as shall be required pursuant to any law or governmental regulation or ruling. Withholding tax rates are 10 3 The 10 is in respect of the tax liabilities of the non-resident contractor while the 3 is for the tax liabilities of the employees of the non-resident contractor. How do I calculate withholding tax.

Assuming that the foreign service provider is based in Singapore if the service is considered under Special Classes of Income eg. The withholding tax in Malaysia is an amount withheld by the party making payment payer on income earned by a non-resident payee. Lets assume the withholding tax rate is 10.

When Company M makes payment to Company N RM9000 will be paid to Company N. Examples of Withholding Tax Incomes. The dam will take 1 year to be built.

You may calculate your yearly wage by multiplying your taxable gross wages by the number of pay periods in a year. Base amount for applying WTH tax percentage is always GROSS AMOUNT. The most common form of income and one of the largest sources of tax revenue for tax authorities is that collected from individual income tax receipts.

Company purchases raw material from vendor of 1000 with 20 input tax. Withholding tax means an amount representing the tax portion of an income of a non-resident recipient withheld by the payer in Malaysia. Withholding taxes are withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia LHDN.

For example A engages B who is a foreign consultant to give consultation on a project and. Under the current withholding tax regime under the Income Tax Act 1967 ITA payments made by a resident for technical advice assistance or services in connection with technical management or administration performed by a non-resident IN Malaysia is subject to a withholding tax rate of 10 section 4Aii 109B of the ITA. The amount of federal income tax withheld was computed as follows.

Based on the Income Tax Act 1967 a non-resident of Malaysia will be liable to payment of withholding tax on interest income if he derives interest rates from loans in Malaysia. 102019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia.

Withholding taxes are taxes that are deducted from the source. Company N is a foreign company providing services to a Malaysian company called Company M. The malaysian income tax act 1967 ita 1967 provides that where a resident is liable to make payment as listed below other than income of non-resident public entertainers to a non-resident he shall deduct withholding tax at the prescribed rate from such payment and pay that tax to the director general of inland revenue within one month.

Gross amount 1000 net amount 200 tax 1200 Net amount 1000 and tax amount 200. Withholding taxes are taxes that are deducted from the source. Technical Fees it will.

Withholding tax is an amount that is withheld by the payer on income earned by a payee who is not a resident in Malaysia. The source would usually be other countries. Here I will share 4 things Yamae needs to know about withholding tax on interest income if Mochiko Co.

The amount is then paid to the Inland Revenue Board of Malaysia IRBM. Ltd a foreign company earns interest income from its subsidiary. The gross amount which billed from Company N is equivalent to RM10000.

However if it is proven otherwise the withholding tax on services is exempted under Income Tax ExemptionNo9 Order 2017. For example in the United States this source of taxation accounts. Payer refers to an individualbody other than individual carrying on a business in Malaysia.

New Withholding Rules On Payments Of Professional Talent And Commission Fees Grant Thornton

Creating An Employee Payslip Free Payslip Template Excel Factorial

.png?sfvrsn=c37bebe1_3)

Iras Qualifying Child Relief Qcr Handicapped Child Relief Hcr

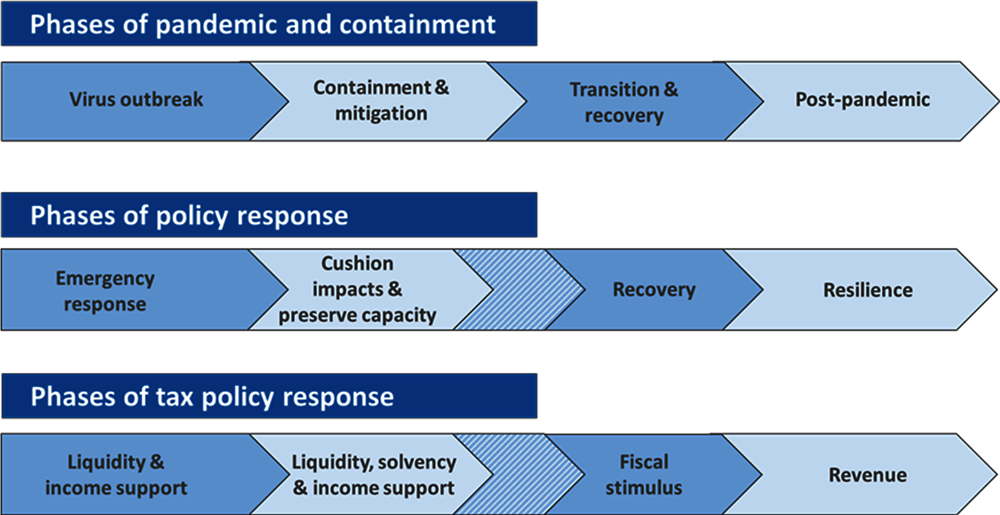

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

Tax Avoidance In Sub Saharan Africa S Mining Sector In Departmental Papers Volume 2021 Issue 022 2021

Stories Rotary Club Of Vancouver Arbutus

Jordan Individual Tax Administration

Tax Considerations For Foreign Entities With Or Without Physical Presence In Malaysia Donovan Ho

How To Calculate Hypotax Eca International

Here Are 8 Important Clauses In A Sale And Purchase Agreement Spa

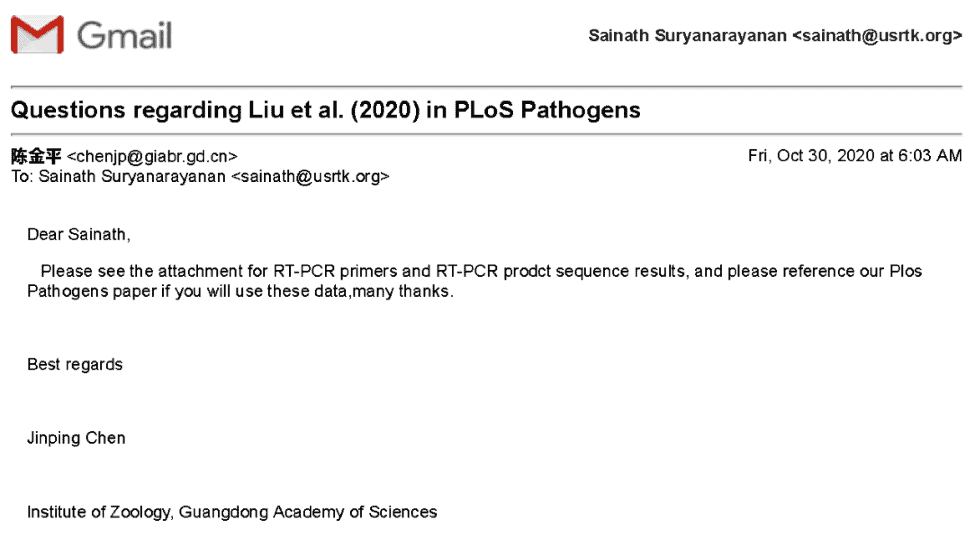

Our Reporting On The Origins Of Covid 19 Gain Of Function Research And Biolabs U S Right To Know